Free Pro Forma Report

See Your In-Depth, Customized IST Report

What is the Pro Forma Report?

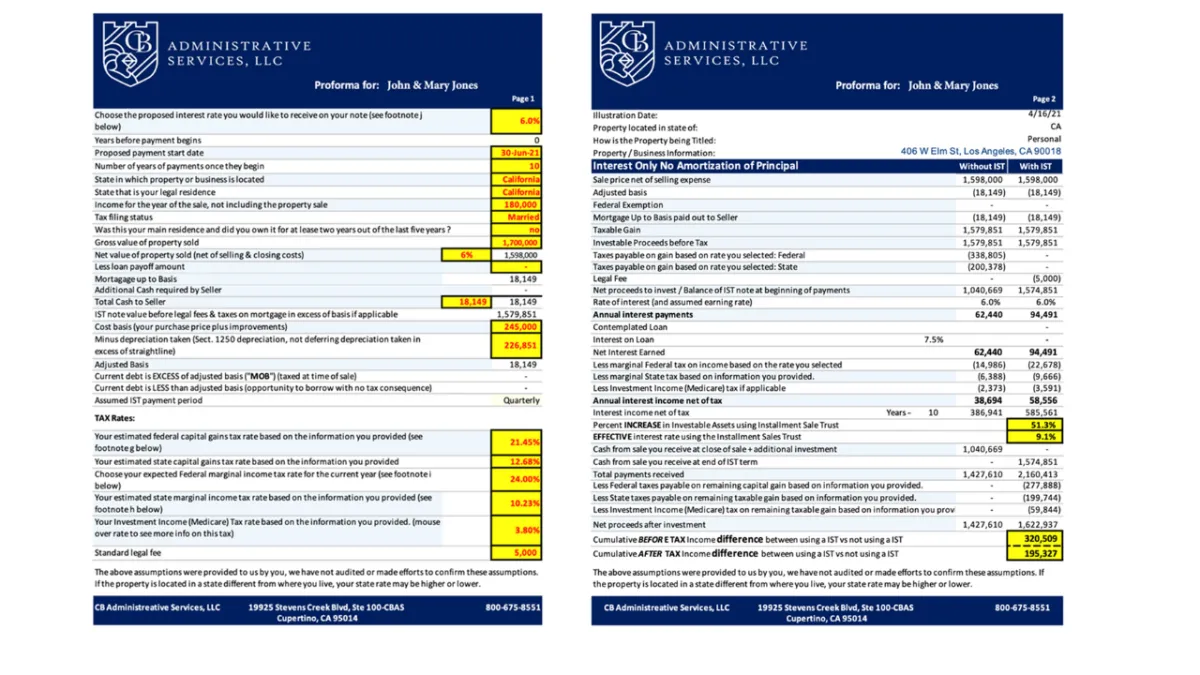

The Pro Forma Report is a 2-page report about the numbers of your asset. Every Prof Forma Report runs a tax assessment on your asset, showing the almost exact amount of taxes to be paid at closing. This tax assessment is done with your CPA/Accountant and uses numbers directly from your previous year's taxes.

The Pro Forma Report was created to thoroughly compare the difference between using an IST to a traditional sale. This is an accurate comparison and uses your numbers. This report is typically filled out with your CPA or Attorney.

STEP #1 of 2: Please watch this short video

STEP #2 of 2: Fill out the IST Pro Forma Report to see what your post-sale income will be.

All of your information is stored safely and securely.

Ready to start your own Structured Installment Sale Trust (SIS Trust) plan?

Schedule a 15-minute phone call for further questions or getting started.

Nothing on this site should be interpreted to state or imply that past results are an indication of future performance. This site does not constitute a complete description of our investment services and is for informational purposes only. It is in no way a solicitation or an offer to sell insurance, annuities, securities or investment advisory services except, where applicable, in states where we are registered or where an exemption or exclusion from such registration or licensing exists. Information throughout this internet site, whether stock quotes, charts, articles, or any other statements regarding market or other financial information, is obtained from sources which we, and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Neither our information providers nor we shall be liable for any errors or inaccuracies, regardless of cause, or the lack of timeliness of, or for any delay or interruption in the transmission thereof to the user. All investments involve risk, including foreign currency exchange rates, political risks, different methods of accounting and financial reporting, and foreign taxes.