What is a Structured Installment Sale Trust (SIS Trust)?

A Structured Installment Sale Trust (SIS Trust) is a trust arrangement that combines special-purpose vehicles with installment sales. This financial strategy is commonly used in property transactions, especially for business sales, to defer capital gains tax over time. When structured correctly, they can grow from the entire principal amount sold to the trust, growing from the taxes you deferred. This deferral can be for generations.

Income is the primary goal of the SIS Trust. We can maximize income by deferring the tax, then compounding growth and return from the deferred taxes. With this strategy, we can yield additional returns from cash that would have otherwise been subject to capital gains tax.

Established by Ernst & Young in 1971, the SIS Trust has been around for decades. The Structured Installment Sale Trust strategy is 100% IRS Compliant since it has a similar structure to a 401(k):

Untaxed on the way in

Grow

Taxed as income on the way out

The Structured Installment Sale Trust uses IRS tax code 453, a Delaware business revocable trust. The idea behind this strategy is to defer the taxes on the way in by avoiding the taxable event at sale. Since proceeds go into the trust instead of your bank account, there is no constructive receipt.

According to the IRS code, you are allowed a 6% (net after fees) payout from the structured installment sale, which we guarantee through financial planning and investment strategies. Additionally, cash in the form of loans from the assets within the trust is permitted, allowing cash liquidity for other investments. For this reason, it poses a great alternative to a 1031 exchange. When using this, your dollar is still growing in the trust when loans are taken out, allowing 1 dollar to be used two times.

Some of the Key Benefits of the SIS Trust Include;

WARNING: This is NOT a Deferred Sale Trust or Monetized Installment Sale.

These financial vehicles are out of date and will likely not last through the near future. Please, talk to a professional from No1031.com for accurate, up-to-date, and reliable information regarding SIS Trusts.

What is a Structured Installment Sale?

The Internal Revenue Code (IRC), specifically Section 453, lays out the rules for handling the profits from an "installment sale." So what's an installment sale? Well, imagine you sell a piece of property, but instead of getting all the money upfront, you'll get paid in installments over time, with some of these payments coming in the following tax years.

Usually, when you make money, you have to pay taxes on it right away. But with installment sales, it's a bit different. You only pay taxes on the money you've received so far. This is called the "installment method" of accounting.

Simply put, this method allows you to push the recognition of your profit from the sale into future years when you receive the payments. If you sold a property that increased in value over time, you only need to report and pay tax on the profit you made in the current tax year.

This method can also be used instead of a Section 1031 tax-deferred exchange. 1031 is the rule for swapping one property for another without paying taxes immediately; deferring them. What if you plan to do this swap, but it fails in the next tax year? Safety nets, called "safe harbors," can still allow you to use the SIS Trust or installment method.

There are specific rules about when you can access the money from the sale and what happens if you can't find a replacement property. If you stick to these rules, you can still report your income using the installment method even if the exchange fails or goes into the next tax year. For this reason, SIS Trusts are an excellent way to save a soon-failing 1031 exchange.

How Does a Structured Installment Sale Trust Work?

Step 1: Seller SELLS the asset to the Trust in exchange for a Secured Note

Step 2: The Trust sells the assets to the buyer, and the proceeds come back to the Trust

Step 3: Trustee invests proceeds for a significant return

Step 4: The note pays out quarterly income

Step 5: At the 10th year, the Trust pays out the proceeds and growth returns or renews for another 10 years (Like a refinance). This can go on for generations.

Do You Have Liquidity?

Short Answer: YES

The most unsettling part about most tax-deferring transactions is the liquidity. With the SIS Trust, you have fully compliant liquidity where you can withdraw from the principal invested at any time. By doing so, you will have to pay the capital gains taxes owed on a pro-rata basis.

Therefore, if you want to leave the SIS Trust and simply place all the funds in your bank account, you are fully allowed to do so. This is one of the most appealing parts of the SIS Trust because it gives you more options.

For example, if you have a taxable gain of $1,000,000 and owe the IRS 40% capital gains tax, every $1 you withdraw from the original $1,000,000 invested, you will owe $0.4 to the IRS.

Why is this Legal?

Understandably so, this is the most common question we get.

The SIS Trust only defers the capital gain tax from the transaction, not the payouts. When you receive income from the trust, you pay income tax based on your tax bracket, like any other income. This means the IRS is still getting their cut. If you keep the trust for generations (100s of years), the IRS will make more money from the SIS Trust payouts in the long run from the income tax than they would have from the capital gain at sale. This is because you will be more profitable in the long run by gaining interest on the taxes deferred.

Additionally, the SIS Trust complies with IRS code 453, the installment sale. Any loans or monetization from the assets within the trust are granted without monetizing the secured note the seller receives. Therefore, to take a loan from the trust, collateral must be from a different asset, NOT the secured note. Avoiding this fatal move separates us from the notorious monetized installment sale on the IRS Dirty Dozen list.

Since you will be paying income tax on any income from the SIS Trust, we are following all rules and regulations. Additionally, we use life insurance to wash additional taxes, as stated in IRS code 7702. This can only be done for proceeds granted after the age of 62.5. This is a 100% legal way to make your sale tax-free instead of just tax-deferred.

Additionally, the transaction is done at Arms Length, meaning the buyers and sellers act independently without one party influencing the other. We ensure this is done using our third-party trustee service, IST Admin Services, or CB Admin Services.

The assets within the trust can not be directly under your name to avoid constructive receipt, AKA taxes owed. This can be unsettling for SIS Trust users since the assets are under a different name; however, the secured note protects your interest. With the secured note granted to you at the sale, you collateralize the trust, maintaining full control. We will go into this in the next section.

By following these specific rules and guidelines, all following current IRS Rulings, we can perform Structured Installment Sale Trusts legally. All this information can be traced back to specific IRS codes, rulings, and letters. We are fully transparent about the process and are happy to talk to your CPA or Tax Attorney about any specific questions.

We have trained over 100 CPAs in this area and will happily talk to yours, too! We are not hiding any cards and are more than willing to answer any additional questions you, your lawyer, or your accountant may have.

For additional legal questions, please contact us at +1 (800) 345-9808.

Do You Have Control?

Upon selling your asset to the SIS Trust, you receive an interest-only secured note. According to Investopedia.com, “A secured note is a type of loan or corporate bond that is backed by the borrower's assets as a form of collateral.” This means that the trust assets are tied to your secured note.

For example, the bank receives a secured note against your house (mortgage) or car (auto loan), which states that you are to give your asset to the bank if you don't pay. This works similarly with the SIS Trust, in which we guarantee you 6% (net after fees) payments on the principal trust value. If we don’t, we are then required to give you your original principal amount invested.

So, how is this control?

You choose your collateral. For example, if you do not want to use our investing strategy, you can choose not to use our investments as collateral. You entirely dictate what your note will be collateralized against, giving you full control.

However, if you choose to do this, we can no longer guarantee 6% (net after fees) payments with your investments, forcing us to amend the secured note so we are not on the hook in case your investment underperforms.

We use principally insured insurance products combined with proven investment strategies to ensure guaranteed payment to the interest-only secured note. Since you only receive income from the principal growth, you are never required to pay capital gains tax, only income tax based on your current tax bracket.

If you decide to take a larger payment that affects the principal investment, you are required to pay capital gains tax on a pro-rata basis, as stated in the “Do I Have Liquidity?” section of this document.

How do the investments grow?

A Structured Installment Sale Trust (SIS Trust) is an excellent tool for tax-deferred growth, leveraging the power of compounding interest. Here's how it works:

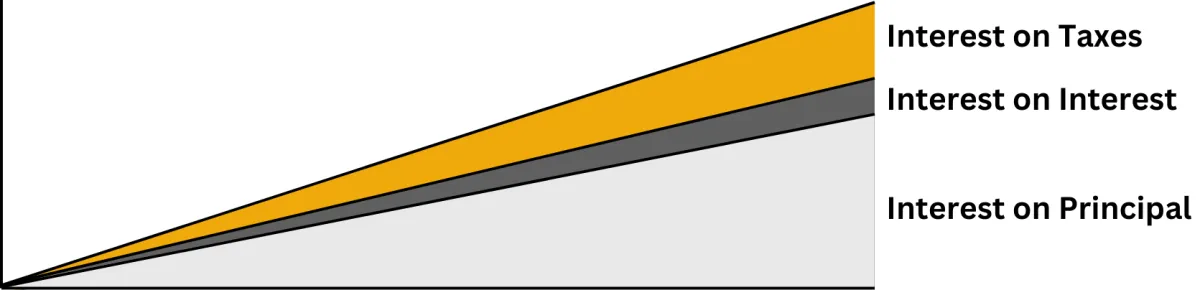

When you sell an asset through a SIS Trust, the proceeds from the sale are invested by the trustee. The money in the trust isn't taxed until it's withdrawn, which allows it to grow over time without the immediate burden of taxation. This offers three distinct levels of compounding interest.

1. Interest on Principal: This is the most straightforward level of compounding. The principal is invested, or the initial money from the asset's sale. The returns or interest from this investment are added back to the principal, thus increasing the total amount of money that can earn interest.

2. Interest on Interest: As the interest from the principal is reinvested and generates its own interest, this second layer of compounding comes into play. Over time, this can significantly increase the growth of the investment.

3. Interest on Taxes Saved: Finally, because the money in the SIS Trust is not immediately taxed, the amount that would have gone towards taxes is instead earning interest. This is effectively another layer of compounding, allowing the funds that would have been lost to taxes to contribute to the overall growth of the trust.

By utilizing these three layers of compounding interest, a Structured Installment Sale Trust can help the proceeds from a sale grow significantly over time, maximizing the benefit of tax deferral.

How does "Payout + Growth" Work?

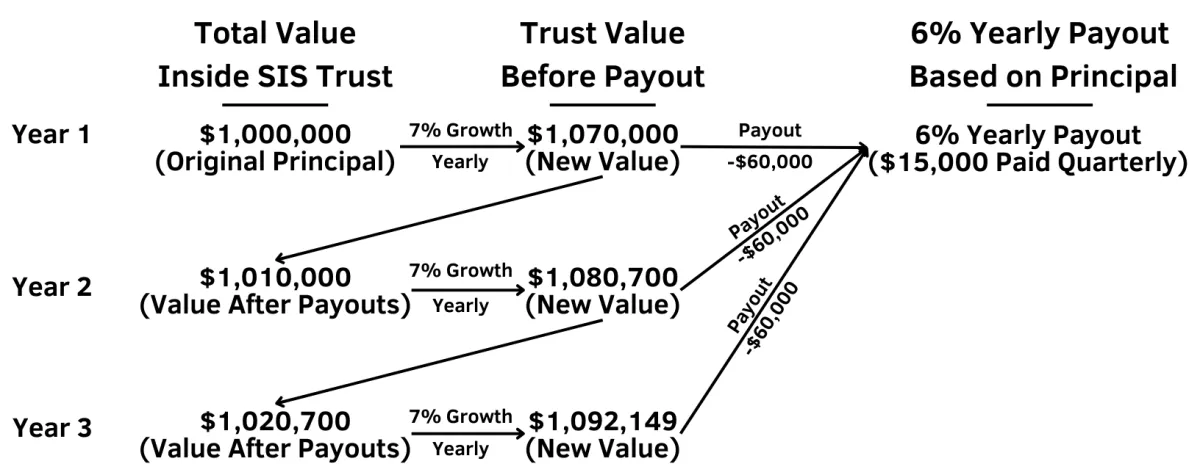

The Structured Installment Sale Trust (SIS Trust) experiences growth in addition to your quarterly payouts.

In the following example, a $1,000,000 asset is sold and proceeds land in the trust. There is a 7% yearly gain from the trust and a 6% (net after fees) yearly payout based on the original principal (paid quarterly). This 6% (net after fees) payout will always be paid based on the original principal, not the current value of the trust.

That being stated, the note can always be refinanced to the new trust value; however, there is a 10% revenue share on gain (this does not effect principal). For example, if the original $1,000,000 grows to $1,500,000, 10% of gain ($50,000) is obligated to a revenue share.

Note refinances can be done whenever the note holder decides; however, they are mandatory after 10 years.

Can You Pass This on to heirs?

The SIS Trust may absolutely be passed on to heirs. When the promissory note is passed on, there is a step up in basis on the trust value.

For example, there is $1,000,000 is the SIS Trust with a basis of $500,000. This SIS Trust grows to $9,000,000 by the time of your passing, granting your successors the note with a step up in basis. Similar to how real estate works, the new principal basis is $9,000,000 instead of the original $500,000.

This allows your heir to either take the cash or receive an income stream from the new principal amount ($9,000,000). This makes the SIS Trust an excellent generational wealth tool for succession planning.

Where Does the Tax Go?

It's crucial to note that the deferred tax liability does not disappear. The SIS Trust just defers the ‘taxable event.’ The capital gains tax is then paid as the seller receives the SIS Trust income. The key benefit lies in the deferral and potential for the overall tax burden to be spread out, not eliminated. With asset appreciation combined with specific, proper management, the trust's growth will outperform the income tax rate, allowing much more income.

All that being said, using financial strategies such as whole life insurance, it is possible to completely wash the capital gains tax from the sale over some time. Life insurance allow tax-free withdraw when above the age of 62.5. Even if you need access to capital, you can take low-interest loans from the assets within your trust, allowing liquidity while your assets continue to grow.

We would like to note that you cannot monetize the secured note itself or else this turns into a monetized installment sale, which is NOT IRS-approved and will result in paying capital gains tax. The monetized installment sale is only for farm-related products. You can learn more about the monetized installment sale through our partner company, CB Farmer's Trust.

Who Benefits From a SIS Trust?

Anyone who owns a primary residence, business building, commercial real estate, or investment real estate may qualify for a Structured Installment Sale Trust. Homeowners looking to downsize, landlords, investors, and business owners typically benefit the most. An Installment Sale Trust is the ONLY option that allows you to have a steady guaranteed income for years after selling your property. The next generation can also inherit this income, so your investments will live on.

SIS Trust FAQ

What are the fees?

1% annual fee of total trust value. .5% goes to the trustee and .5% goes to the Registered Investment Advisor (1% per year total).

A 1-time $10,000 fee taken at escrow close to pay for the trust establishment. This fee is directly sent to the tax attorney that establishes the trust.

$850 paid annually from the trust to file the trust's tax return

$40 paid monthly from the trust for the Trust's Citi Bank Account ($85 total, we cover $45)

*The 6% yearly income steam is net after all fees and based on the principle invested.

Can I do this with my own trust?

No, you can not use this for your current trust. Additionally, you can not be the direct trustee of the trust. You maintain control over the trust with the promissory note granted to you at the time of the sale. This note fully protects your assets in the trust and grants you control.

Do I have to put all of my gain inside the trust?

No, we recommend only putting the taxable gain inside the trust. You are allowed to take your basis out, untaxed. If you want a larger, passive income, and do not require a large sum of cash, we recommend putting the entirety inside the trust instead.

What are the downsides?

- Fees.

- You can not be the trustee (which is not necessarily bad).

- There has to be a business purpose for the trust other than deferring taxes. To combat this, there is a profit sharing agreement on the additional upside after payouts (never effecting principal).

How can I see the money in the SIS Trust?

You can see the funds from the Citi Bank app on your phone, just like having an additional bank account. Withdrawals from principal require documentation since they trigger certificate of receipt, requiring capital gains to be paid.

Can I take the 121 tax exemption out like my basis?

Yes; however, on a pro-rata basis. Married couples receive up to a $500,000 tax break and singles receive up to a $250,000 tax break. For example, you are married and have a $1,000,000 personal residence with a $100,000 basis ($900,000 taxable gain). in this case, you would be able to access 1/10th of the 121 exemption since you are only taking 1/10th of the assets value. The rest of the money will be left in the trust.

if you decide to sell and pay the tax, you will be on the hook for capital gains tax on $400,000 if you're married or $650,000 if you are single. Your capital gains tax bracket is determined by the entire gain before the 121 exemption.

What is a Monetized Installment Sale? (We do not do this)

Monetizing is the act of taking a loan from the installment trust after it is established. This collateralizes the trust in your name, which is illegal since the trustee is technically the "Owner" of the asset. Any loans taken with the trust as collateral are subject to taxation and penalties; therefore, we do not allow them. Monetized Installment Sales are on the IRS Dirty Dozed list and are NOT analogous to Structured Installment Sales.

What if I want Out of the Trust?

At any time, you may leave the trust. By doing so, you are subject to the original capital gains tax you would have paid. This will immediately fulfil the financing agreement and all pre-taxed funds will be sent to you. If you previously performed a SIS Trust with your personal residence, you will still receive the 121 tax exemption ($250,000-$500,000 tax break) at the time of liquidation.

Can I pass the SIS Trust to my heirs?

Yes, the SIS Trust can be passed down from generation to generation. After passing, the SIS Trust receives a step up in basis, granting your heirs the option to liquidate tax-free or continue to grow and collect from the trust.

Ready to start your own Structured Installment Sale Trust (SIS Trust) plan?

Schedule a 15-minute phone call for further questions or getting started.

Nothing on this site should be interpreted to state or imply that past results are an indication of future performance. This site does not constitute a complete description of our investment services and is for informational purposes only. It is in no way a solicitation or an offer to sell insurance, annuities, securities or investment advisory services except, where applicable, in states where we are registered or where an exemption or exclusion from such registration or licensing exists. Information throughout this internet site, whether stock quotes, charts, articles, or any other statements regarding market or other financial information, is obtained from sources which we, and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Neither our information providers nor we shall be liable for any errors or inaccuracies, regardless of cause, or the lack of timeliness of, or for any delay or interruption in the transmission thereof to the user. All investments involve risk, including foreign currency exchange rates, political risks, different methods of accounting and financial reporting, and foreign taxes.